Achieving financial stability is a quest that requires diligent planning and consistent effort. Mastering money management isn't just about accumulating wealth; it's about developing healthy fiscal habits that empower you to prosper.

It involves creating a detailed budget, tracking your expenses, and making informed choices about your revenue.

A solid money management plan can minimize financial anxiety, promote your aspirations, and provide a sense of assurance for the future.

The Path to Prosperity

Achieving abundance is a journey that requires careful planning, disciplined actions, and a steadfast commitment to your goals. It's about crafting a life where money read more works for you, providing security, opportunities, and the autonomy to pursue your passions. Begin by understanding your current standing, outlining your dreams, and developing a comprehensive plan that aligns with your values.

- Develop healthy consumption habits to ensure you're optimizing your resources effectively.

- Investigate diverse accumulation options that align with your appetite and long-term objectives.

- Harness the guidance of qualified professionals who can provide personalized insights tailored to your unique circumstances.

Remember, creating financial freedom is a marathon, not a sprint. By remaining focused, resilient, and informed, you'll pave the way towards a future of success.

Mastering Money Management: Simple Budgeting Tips for Beginners

Taking control of your finances can feel overwhelming, but it doesn't have to be. Creating a budget is the first step towards achieving your financial goals and getting on track to reach financial freedom. Begin by monitoring your income and expenses for a period. This will give you a clear understanding of where your money is going. Once you have a solid grasp of your spending habits, you're able to start implementing a budget that works your needs.

- Establish realistic financial goals.

- Classify your expenses into must-haves and wants.

- Assign a certain amount of money to each category.

- Review your budget regularly and make adjustments as needed.

Keep in mind that budgeting is an ever-evolving process. Be flexible and avoid getting discouraged if you slip up. The key is to persist and adopt positive changes over time.

Begin Your Investment Journey: A Practical Guide

Embarking on the world of investing can seem daunting, especially if you're just launching out. However, with a little knowledge and preparation, anyone can begin investing successfully. This guide aims to provide some practical tips for beginners looking to navigate the terrain of the financial realm.

One of the most crucial steps is understanding yourself about different investment choices. Consider a variety of assets, such as stocks, bonds, mutual funds, and real estate. Each asset class carries its own level of risk and profitability.

- Establish your investment targets. Are you planning for retirement, a down payment on a house, or something else? Your goals will shape the types of investments that are right for you.

- Formulate a budget and stick to it. Investing should be part of your overall financial strategy. Only invest money that you can afford to lose.

- Diversify your investments across different asset classes to mitigate risk. Don't put all your eggs in one basket.

Bear in mind that investing is a long-term journey. Be patient and don't fret when the markets move. Stay informed about your investments and make adjustments as needed.

Mastering the Mental Game of Finance

Navigating the realm of personal finance often requires more than just crunching numbers. It involves a deep understanding of its own psychological tendencies. Our emotions, beliefs, and past experiences heavily shape our financial choices, sometimes leading to inappropriate outcomes. By investigating the psychology of money, we can develop valuable awareness to make more informed financial decisions.

- Acknowledge your economic patterns.

- Question unhelpful money beliefs.

- Foster a long-term investment framework.

Remember that financial stability is a journey, not a destination. By continuously educating your understanding and adjusting your strategies, you can achieve your financial objectives.

Unlocking the Secrets of Passive Income

Imagine waking up every day to a steady stream of income rolling in, even while you sleep. This is the dream that millions are chasing with passive income streams. Passive income isn't about getting rich quick; it's about creating a system that works for you automatically. It's about finding paths to generate money without the constant hustle and grind. Whether you're looking for extra spending funds or aiming for financial independence, passive income can be a powerful tool.

- One popular method is investing in the stock market.

- Another alternative is creating and selling online courses.

- Land investments can also be a profitable source of passive income.

The key to unlocking the power of passive income lies in finding what works best for your skills and your aspirations.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Christina Ricci Then & Now!

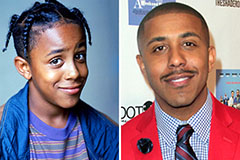

Christina Ricci Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!